On October 8, Villa Doria D’Angri, Naples, hosted the climate finance workshop “Leveraging Climate Finance to Achieve Agenda 2030: a Focus on SDG 13”, organized by Francesca Battaglia, Claudio Porzio and Gabriele Sampagnaro.

The event was joined by speakers from prestigious institutions, including the European Central Bank, European Commission, Federal Reserve Bank of New York, Banque de France, University of Zurich, and University of Dublin.

The objective of the workshop was to highlight how climate finance can contribute to the achievement of SDG 13, by focusing on the promotion of climate change mitigation and actions at all levels. SDG 13 aims to include climate change as a priority issue in the political agendas, strategies, and programs of national and regional governments, businesses, and civil society, to improve the response to the problems it causes, such as natural disasters, and to promote education and awareness among the entire population. In this context, all the authorities, central banks, and supervisors are called to give their contribution. Their purpose is to share best practices, contribute to the development of climate-related and environmental risk management in the financial sector, and mobilize mainstream finance to support the transition toward a sustainable economy. They are then required to develop climate scenarios for the financial system in two ways: by improving their long-term climate scenarios and by establishing a conceptual framework for developing short-term climate scenarios. They should also examine the implications of climate change for monetary policy.

To discuss insights and perspectives on how to address these challenges, the workshop gathered leading experts in the field such as Lucia Alessi (European Commission, JRC), Livio Stracca (European Central Bank), Cristina Peñasco (Banque de France), Stefano Battiston (University of Zurich), Hyeyoon Jung (Federal Reserve Bank of New York) and Gabija Zdanceviciute (University of Dublin).

Below you will find a summary of each speaker’s presentation along with a short biography.

Lucia Alessi (European Commission-JRC) is Team Leader at the Joint Research Centre of the European Commission, where she is responsible for research in support of EU policymaking in the field of finance, including banking and financial stability, corporate finance, as well as digital and sustainable finance. From 2007 to 2015 she worked at the European Central Bank, where she served in various DGs, including Research, Economics, and Macroprudential Policy and Financial Stability. Lucia chairs the EC Sustainable Finance Research Forum

Her presentation (“Climate stress-testing: overview and modelling issues”) looked at climate stress-testing from both a scientific and a policy perspective. In particular, she analyzed climate stress testing as a key policy tool and the main challenges of climate stress testing compared to traditional stress testing, focusing on the short-term impact of long-term dynamics, the nature of shocks and data issues.

Livio Stracca (European Central Bank) is the Deputy Director General Macroprudential Policy & Financial Stability at the European Central Bank and an adjunct Professor at the University of Frankfurt J.-W. Goethe. He has a PhD in Economics and a postgraduate degree in European Union Law. He has published extensively in international macroeconomics, international finance, and monetary economics. He is also the Chair of the Climate Scenarios Workstream in the Network for Greening the Financial System (NGFS).

His presentation (“Measuring climate risk: NGTS scenarios”) focused on NGTS short-term and long-term scenarios (https://www.ngfs.net/sites/default/files/medias/documents/conceptual-note-on-short-term-climate-scenarios.pdf)

Cristina Peñasco (Banque de France) is a Senior research economist and expert in climate and sustainable finance at the Centre for Climate Change of the Banque de France and an Associate Professor in Public Policy at the University of Cambridge. With more than a decade of experience working at the intersection between academic and policy, her research focuses on environmental economics, energy innovation, and the evaluation of policies for decarbonization.

Her speech (“The role of central banks and other financial institutions in mitigation and adaptation”) emphasized the critical role of climate finance in meeting Sustainable Development Goal 13 (climate action) and the Paris Agreement’s targets. It emphasized the need for substantial investment (up to $12 trillion annually by 2030) in green energy, clean technologies, and adaptation, with a particular focus on closing the finance gap in low- and middle-income countries. She highlighted that Central banks and financial institutions are called to support this transition, but public policies and corporate actions are also crucial for success.

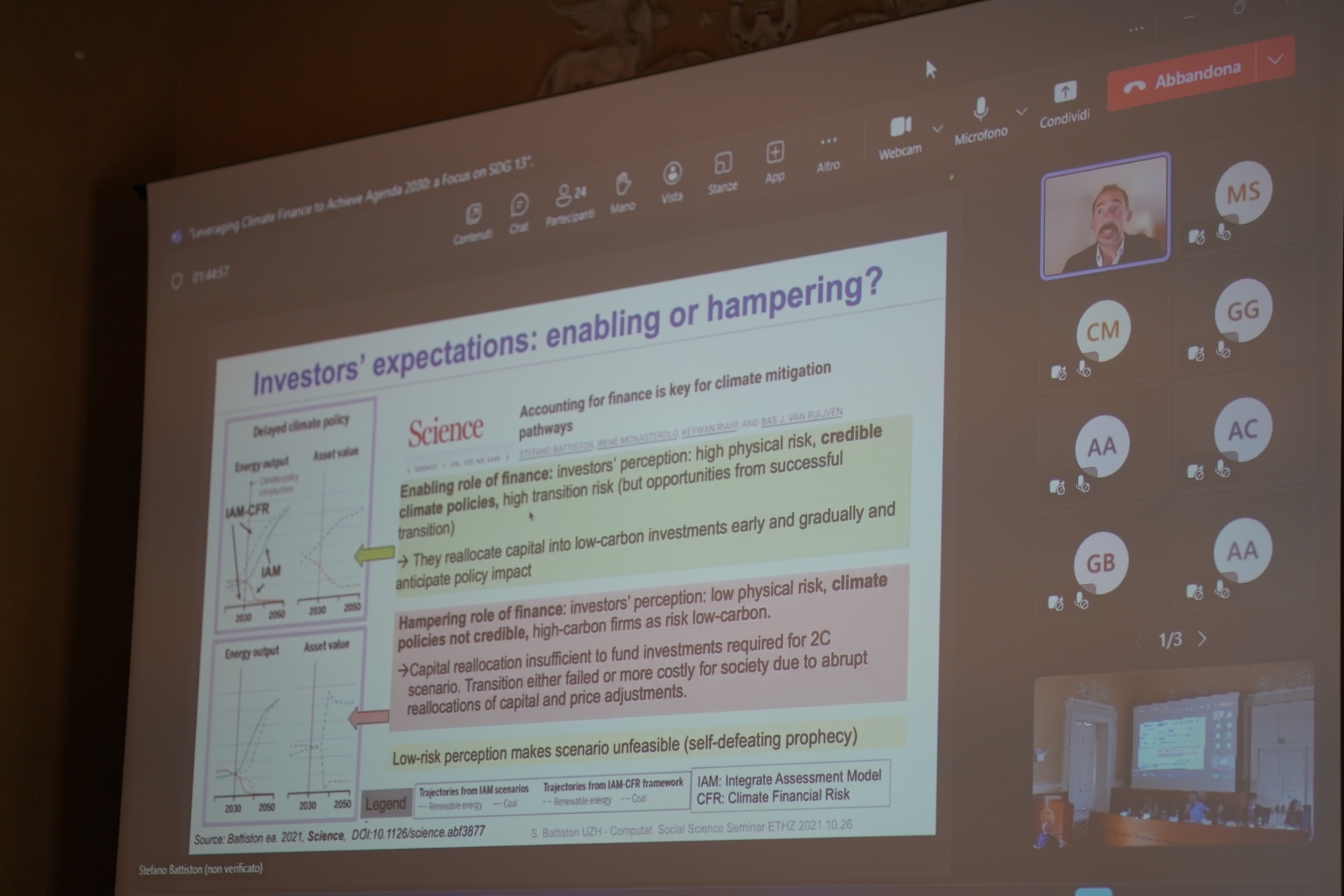

Stefano Battiston (University of Zurich) is Full Professor of Economic Policy at Univ. of Venice, Department of Economics and Associate Professor of Sustainable finance and networks at the University of Zurich, Department of Finance. He has served as Lead Author of the IPPC Report Chapter 15 Finance and Investments. He is a leading scholar in the fields of sustainable finance and financial risk in networks. His contributions are documented in 60+ publications, including on prestigious journals such as Science, PNAS, Management Science, Nature Communications and Nature Climate Change. His scientific methods on climate-related financial risks have found several applications among financial authorities. He has contributed as coordinator, or partner, to international research projects of the Future Emerging Technologies program of the European Commission.

His presentation (“Climate finance needs adequate risk assessment”) focused on the IPCC AR6 report, which identified inadequate risk assessment as one of the barriers to finance playing the enabling role for climate action that it is often assumed to play. He argued that adequate risk assessment, in turn, requires the adoption of truly forward-looking risk assessment, making consistent use of climate policy scenarios such as the NGFS Short-Term Scenarios which will be released early next year.

Hyeyoon Jung (Federal Reserve Bank of NY) is a Financial Research Economist at the Federal Reserve Bank of New York. Her research focuses on international finance, financial intermediation, asset pricing, and climate finance. Her research has been accepted for publication in journals including the Review of Financial Studies. She hold a Ph.D. in Finance from NYU Stern, B.S. in Economics from the Wharton School, and B.AS from School of Engineering and Applied Science at the University of Pennsylvania. Prior to graduate school, she worked as an FX & Rates trader at J.P. Morgan.

Her presentation (“Market-based approaches to climate stress testing”) analyzed a market-based approach to assessing the resilience of financial institutions to climate-related risks. This approach uses asset prices to design climate stress scenarios and measure the climate risk exposure of financial institutions. It discussed key applications in the banking sector and highlighted the key advantages of this methodology over other climate stress testing approaches. (https://www.newyorkfed.org/research/staff_reports/sr1058; https://www.newyorkfed.org/research/staff_reports/sr977)

Gabija Zdanceviciute (University of Dublin) is a final year PhD candidate at the University College Dublin (UCD). Her research is in the field of climate finance with a focus on Net Zero portfolio strategies and EU Climate Benchmarks. Gabija’s research is complemented by her industry experience in designing EU Climate Benchmarks for a large asset manager. She previously served as a financial data scientist for a research-driven organization, where she specialized in evaluating the quality of ESG data.

Her presentation (“EU Climate Benchmarks: on the path to Net Zero”) highlighted the EU Climate Benchmarks as an attempt to establish a standard for net zero portfolio strategies. She analyzed the key factors behind the methodological design and how they support the economic transition. Her presentation focused on the market’s adaptation to these benchmarks and the regulatory endorsements that play a critical role in the continued growth of the market segment. She also presents evidence that climate benchmark funds are achieving decarbonization with minimal to no significant risk costs.